Embargoed Press Release

Pulley, the innovative equity management platform, is thrilled to announce its Series B funding round led by Founders Fund, with participation from Stripe, Elad Gil, and other prominent investors. Founded by Yin Wu and Mark Erdmann in 2019, Pulley empowers over 1,700 companies to make smarter decisions about their ownership, streamlining fundraising, hiring, and compliance processes.

The platform's unique approach to equity management sets it apart from traditional cap table management solutions. By providing companies with valuable insights into their equity, Pulley enables strategic decision-making around hiring, fundraising, and tax filings. With a diverse range of clients, including Y Combinator startups and growth-stage companies like Coda, Athelas, and Bitwise, Pulley is committed to supporting businesses at every stage of their journey.

As part of their mission to make it easier for anyone to start a company, Pulley is also introducing a free tier called Pulley Seed, aimed at helping early-stage startups avoid costly equity mistakes. With the new funding, Pulley plans to continue scaling its team and expanding its product offerings, providing even more tools for wealth creation and employee ownership.

Embargoed Press Release

Hi there,

We’re looking forward to announcing our Series B on July 13, 2022. This story is embargoed until Wednesday, July 13, 2022, at 8:00 a.m. PT.

If you have any questions, please don’t hesitate to reach out to laura@pulley.com.

Thank you,

Laura Peng

Marketing at Pulley

Included in this document:

About Pulley

Pulley is on a mission to make it easier for anyone to start a company and envisions a future with more founder-led companies and employee-owners. Founded in late 2019 by Yin Wu and Mark Erdmann, Pulley is the equity management platform that gives founders and employees the tools and insights to make smarter decisions about their ownership. Over 1,700 companies trust Pulley to help with fundraising, hiring, and staying compliant in terms of taxes and accounting.

About the founders

Yin Wu is a serial entrepreneur who sold her last previous company to Microsoft in 2015. Her company Echo Lockscreen became the Microsoft Launcher and Lockscreen on Android. She was one of the youngest principal engineers at Microsoft and worked on products that applied machine learning to mobile products. Prior to Microsoft, Yin studied computer science at Stanford. She dropped out in 2011 to join Y Combinator for her first startup and is a three time Y Combinator alumnus (S11, S13, W20).

Mark Erdmann has been working at startups for the past 14 years. Prior to Pulley, he was a principal engineer at CBRE and led iOS development at The Hunt, which was acquired by Pinterest in 2015. Earlier in his career, Mark was an early engineer at Docker and co-founded MobileCurious, where he provided data engineering and iOS services to various clients, from small startups to large technology companies.

FAQ for reporters

3 categories of questions:

What is Pulley?

What is Pulley?

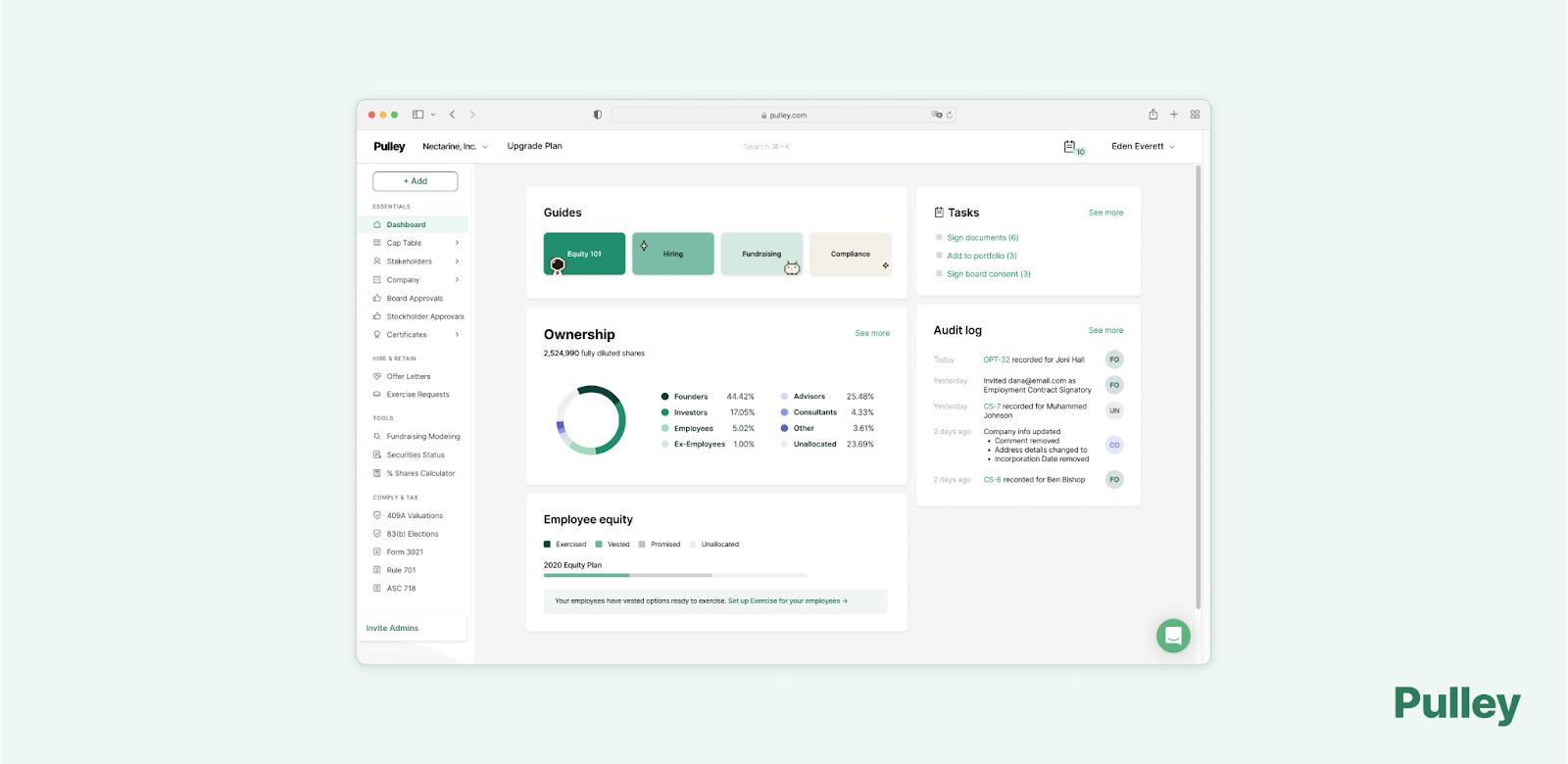

Pulley is a cap table and equity management platform co-founded by Yin Wu and Mark Erdmann. Pulley views equity as one of the most valuable assets a company owns, as it is one of the few assets that can 1000x in value. We take a new and differentiated approach to equity management by helping companies make better decisions around equity allocation – before those decisions are recorded on the cap table.

How is Pulley different from other options for cap table management?

Cap table management has traditionally been siloed in spreadsheets created and managed by legal teams. This creates a lot of complexity and misaligned incentives because equity touches every part of the company as it grows: product and engineering (hiring & equity grants), legal (compliance), and finance and accounting (valuations, fundraising, taxes).

Tracking a company’s ownership is only part of the challenge. The strategic questions that companies have around equity include, “How much dilution will we take if we raise on specific terms? How much equity do I give my early hires?” Pulley gives companies insights into their equity, so they can make more strategic decisions around hiring and fundraising while proactively staying ahead of tax filings and accounting.

How does Pulley support companies at every stage?

At the early stage, we help founders make better fundraising decisions. For instance, over 50% of companies in each Y Combinator batch choose Pulley because we help them prepare for Demo Day. In addition, our product and in-house equity teams help companies save money on legal and tax fees, which are often paid to third parties for managing their cap table and compensation packages.

At the growth stage, we work with companies like Coda, Athelas, Bitwise, and more. These companies choose Pulley because the platform is built to support their equity programs as they scale.

Here’s how Pulley helps companies and their employees make the most out of their equity as they grow:

- Employee experience: To attract and retain great people, companies benefit when they educate employees on the value of their equity. Pulley helps employees understand what they own, make decisions around exercising options, and handles complex tax paperwork to ensure employees retain as much of their wealth as possible.

- Flexible ownership and compensation structures: We support numerous ownership structures and compensation packages, ranging from LLCs and their subsidiaries to milestone based vesting, double trigger acceleration, stock splits, and much more.

- Tax and compliance: We fully execute legal documents, streamlining complex workflows and reducing the need for other tools like Docusign. We integrate with HRIS to support these from end-to-end. This not only saves companies and employees valuable time, but also prevents human errors by eliminating the need for manual entry.

How do you plan to use the new funding?

Continue to build a great product by scaling our team.

We are hiring across product, engineering, design, and other roles. Over 30% of the team is former founders, and we are opinionated about our culture. Being at Pulley is a great training ground for learning what it’s like to be at an early-stage company. By building Pulley, our team gets to also see what it takes to fundraise, hire, and scale the operations of a business as we help many other startups reach these milestones.

Equity in a Downturn

You’re introducing a free tier called Pulley Seed. What motivated this decision?

The fundraising climate has changed drastically in 2022. Public tech companies are down 30-95% from all time highs, and recent IPOs have not performed well. The public markets have impacted startups at every stage.

Meanwhile, new startups have a harder time fundraising and are more cash strapped. We do not want early-stage startups making equity mistakes that impact their entire lifetime because of short-term trade-offs. Equity mistakes are very expensive to correct, and we want founders to be successful long-term. That’s why we’re making it easier for them to join Pulley with our free tier, Pulley Seed.

Who’s eligible for the free tier? What can they expect from Pulley?

New startups can get started for free with our Pulley Seed plan. Our tools help them model and compare different funding scenarios, raise capital, and set up equity grants for employees – all at no cost. Basic legal agreements, including fundraising documents and equity grant agreements for U.S. and international employees, are pre-loaded and fully integrated into the platform.

Our goal is to support startups in the initial stages of hiring and fundraising until their company raises additional capital. With Pulley Seed, startups can get started right away and save thousands on legal fees.

How does the slowdown in venture funding affect startups? How is it affecting Pulley?

Better tools for fundraising and hiring become even more important in a bear market. In a bull market, decisions around equity are easier because the only question a startup has to answer is how high is the valuation.

In a bear market, the tradeoffs around equity are less straightforward. When the fundraising market is down, founders ask questions like, “How do I weigh the impact of a down round? What about a bridge round? What does this mean for existing stakeholders? Do we take more dilution now or later?” It also raises questions around hiring and compensating employees: “Do we take a lower valuation to get better multiples for employees? Should we hire fewer people with larger grants if the company is not going to get a big step up in valuation? Do we compete on cash or equity against other startups?”

Cap table management is tracking equity. Pulley extends beyond tracking equity to give companies the tools to better answer their critical business questions around this really valuable asset.

Equity & the Future of Work

What else is on the horizon for Pulley?

One of the largest sources of wealth creation comes from having shares in a business, and we’ve seen that play out for employees at fast-growing venture-backed companies.

However, employee ownership is becoming tablestakes at all companies. Equity comes in different forms, including standard grants for startup employees, tokens for web3 employees, and profit interest for LLCs. There are different programs that company leaders could and should offer employees to help them create and retain wealth. But these programs don’t look the same at every company, and they shouldn’t.

Our goal at Pulley is to make it easier for companies to navigate this space more strategically. We see a huge opportunity to help companies align equity incentives for employees, and we’re expanding our product offering to include more tools for wealth creation. This means companies will also need help with tax and compliance requirements. We are excited to build for these new opportunities.

Series B Investors

Lead Investors:

- Founders Fund (Lead Investor)

- Stripe

- Elad Gil

Funds:

- [Your list of investors]

Angels (not comprehensive):

- [Your list of angels]

Media assets

Pulley, the innovative equity management platform, is thrilled to announce its Series B funding round led by Founders Fund, with participation from Stripe, Elad Gil, and other prominent investors. Founded by Yin Wu and Mark Erdmann in 2019, Pulley empowers over 1,700 companies to make smarter decisions about their ownership, streamlining fundraising, hiring, and compliance processes.

The platform's unique approach to equity management sets it apart from traditional cap table management solutions. By providing companies with valuable insights into their equity, Pulley enables strategic decision-making around hiring, fundraising, and tax filings. With a diverse range of clients, including Y Combinator startups and growth-stage companies like Coda, Athelas, and Bitwise, Pulley is committed to supporting businesses at every stage of their journey.

As part of their mission to make it easier for anyone to start a company, Pulley is also introducing a free tier called Pulley Seed, aimed at helping early-stage startups avoid costly equity mistakes. With the new funding, Pulley plans to continue scaling its team and expanding its product offerings, providing even more tools for wealth creation and employee ownership.